UAE among world’s most attractive retail markets

Strong economic environment, infrastructure benefit retailers

7/9/2015

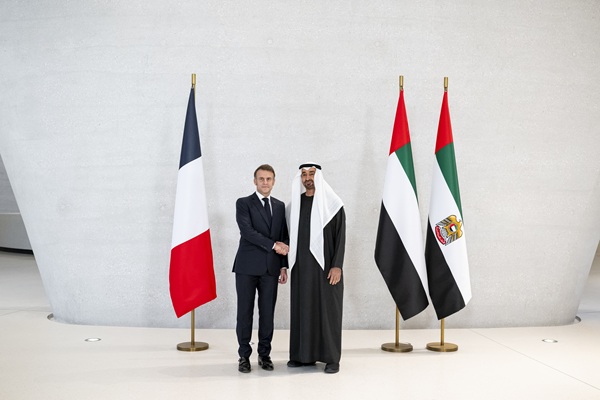

The UAE ranks first in the Middle East and eighth globally as the most attractive market for retailers, thanks to a strong economic environment and infrastructure, a report by a leading consultancy said recently.

"Retailers in the UAE experience some of the best conditions in the world in which to operate in, benefitting from a strong quality of infrastructure and a robust economic environment," Arcadia said in its Retail Operation Index.

"The UAE ranks eighth in the overall rankings and first place in the Middle East, while quality of transportation and ease of getting up-and-running is holding many other countries in the region back," the report said.

The UAE's retail market is vibrant and has a promising outlook as major retail groups are expanding their footprints across the emirates. The retail sector is contributing around one third to the country's gross domestic product (GDP) and is expected to add another five to six per cent in next five-year time. The sector was estimated to be worth Dh120.8 billion in 2014, of which Dh70.6 billion was spent on non-grocery items and Dh50.3 billion on groceries.

A recent report by CBRE ranked Dubai as the second most important international shopping destination globally for the fourth consecutive year, closely behind London, which also retained its number one position.

According to the 2015 edition of 'How Global is the Business of Retail?' by the global property advisor, Dubai has the presence of 55.7 per cent of international retailers, followed by Shanghai with 53.4 per cent, while New York and Singapore make up the rest of the top five international cities for retail representation with 46.3 and 46 per cent respectively.

The Arcadia index ranks 50 international markets according to the five key factors that retailers look to when choosing where to locate their stores; these include infrastructure quality, consumer demand and ease of establishing a business in the first instance. Based on the findings, much of the UAE retail is driven by the tourist industry that further boomed in 2014, and a high calibre infrastructure in the country.

"The strategic location and physical presence of a store will continue to help successful retailers in the UAE make the greatest use of their store portfolios and brand marketing to attract customers," said Christopher Seymour, head of Middle East markets at Arcadia.

"The quality of transportation such as roads and Metro is a key factor contributing to a retailer's success as the growing young population and increased number of expats and tourists make the decision to shop based on their accessibility from direct Metro links to shopping malls."

In the UAE, a healthy performance is forecasted and consumer confidence will be boosted as a result of economic stability, which will, in turn, lead to more spending, higher employment and increased numbers of expats and tourists. Furthermore, in environments such as these, retailers are seeing enhancements in prevalence of foreign ownership, trade freedom and logistics performance across the UAE market, creating a more stable base for operations.

"For retailers with international aspirations, weighing up where, how and when to expand into a new region, country or city is critical if they are to stay ahead of the competition and meet their business objectives. Retailers entering or optimising portfolios in the UAE need to be aware of the demographics and market demands and tailor their portfolios accordingly," said Seymour.

"If a business is going to operate effectively and potentially flourish, it is vital that retailers do their homework. They need to consider data and insight on their prospective markets and consider the varying factors that can impact portfolio success. For instance, a market that is expected to see strong economic growth and is ramping up on infrastructure investment has potential to improve its overall rankings in upcoming years."

Elsewhere in the region, Qatar and Saudi Arabia rank in the second quartile, reflective of its lower ease of doing business rating and comparably less developed infrastructure. This is largely due to challenges associated with the current infrastructure programmes taking place throughout the cities, as well as restrictions in regulations impacting those operating within the country.