Luxury is the 7th Most Intimate Industry in the UAE, According to MBLM’s 2019 Brand Intimacy Study

By Huiming_Shi Sunday, 10 November 2019 11:21 AM

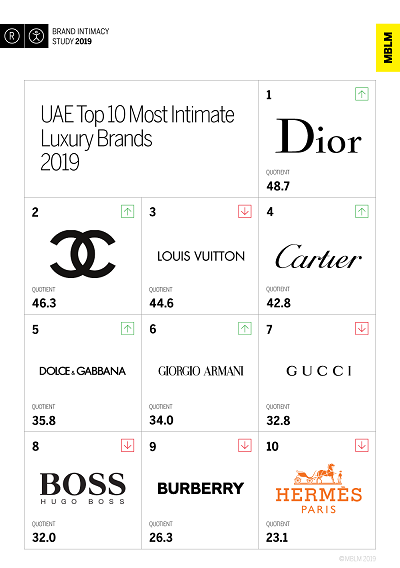

Dior ranks #1 in the luxury industry

In 2019, the luxury industry remains in the 7th rank out of the 15 industries showcased in the 2019 Brand Intimacy Report. Dior rises to the top of the luxury industry, followed by Chanel at #2 and Louis Vuitton at #3. The Top 10 is rounded out by Cartier, Dolce & Gabbana, Armani, Gucci, Hugo Boss, Burberry, and Hermès respectively.

Brand Intimacy is defined as the emotional science that measures the bonds we form with the brands we use and love. Top Intimate Brands outperform top brands in the S&P and Fortune 500 indices for revenue and profit. Consumers are also more willing to pay price premiums for Intimate Brands and less willing to live without them, according to the 2019 Brand Intimacy Report. MBLM leverages the yearly study to help client brands create, sustain and measure ultimate brand relationships.

“Brands in the luxury category rely on creating, sustaining and developing stronger emotional relationships with their consumers. We’ve seen a tremendous increase in the industry around the enhancement and ritual archetypes, indicating that their consumers are changing their relationship to brands in the luxury category,” states William Shintani, managing partner of MBLM.

Other notable findings for the luxury industry include:

- 31% of users report being in one of the three stages of intimacy (sharing, bonding and fusing) with the luxury industry

- Enhancement and Nostalgia are fastest growing archetypes (the type of emotional relationship between a person and a brand) in the luxury category

- Consumers identified Indulgence (close relationship centered around moments of pampering and gratification that can be occasional or frequent) as the top archetype for the luxury industry

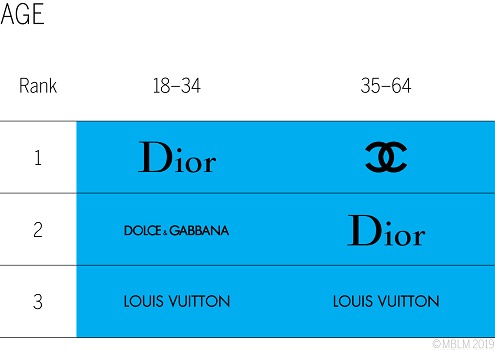

- Dior is ranked as the most intimate brand in the industry and is the #1 brand for millennials and users with low incomes

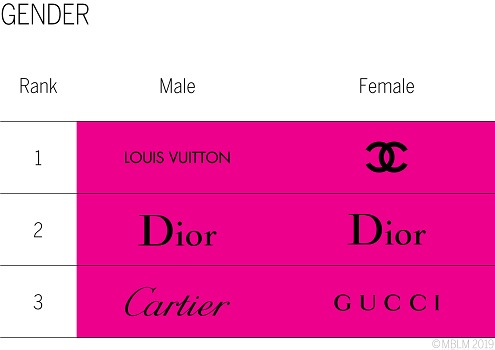

- Chanel ranked #1 with women, users in the 35-64 year segment and users with high-income

- Louis Vuitton is the #1 brand for men across all incomes and socio-economic levels

- 54.7% of users have an immediate emotional connection with Gucci, 11.6% above the industry average

- 15.1% of users in the study consider Cartier to be the most essential luxury brand (brands a consumer can’t live without), 6.3% above the industry average

- Dior, Chanel, Cartier, Dolce & Gabbana, and Armani have improved their ranking in 2019

- Louis Vuitton, Gucci, Hugo Boss, Burberry, and Hermès have fallen in rankings during 2019

-

To view more industry-specific data, please click here. Read our latest article on the luxury industry here.

To download the full Brand Intimacy 2019 Report, please click here or to explore the Data Dashboard, please click here.

Methodology:

During 2018, MBLM with Praxis Research Partners conducted an online quantitative survey among 6,200 consumers in the U.S. (3,000), Mexico (2,000), and the United Arab Emirates (1,200). Participants were respondents who were screened for age (18 to 64 years of age) and annual household income ($35,000 or more) in the U.S. and socioeconomic levels in Mexico and the UAE (A, B and C socioeconomic levels). Quotas were established to ensure that the sample mirrored census data for age, gender, income/socioeconomic level, and region. The survey was designed primarily to understand the extent to which consumers have relationships with brands and the strength of those relationships from fairly detached to highly intimate. It is important to note that this research provides more than a mere ranking of brand performance and was specifically designed to provide prescriptive guidance to marketers. We modeled data from over 6,200 interviews and approximately 56,000 brand evaluations to quantify the mechanisms that drive intimacy. Through factor analysis, structural equation modeling, and other sophisticated analytic techniques, the research allows marketers to better understand which levers need to be pulled to build intimacy between their brand and consumers. Thus, marketers will understand not only where their brand falls in the hierarchy of performance but also how to strengthen performance in the future.

To read a more detailed description of MBLM’s approach, visit our Methodology page.

Add new comment